mississippi income tax rate 2021

IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107. Income Tax Laws Title 27 Chapter 7.

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Find your income exemptions.

. Mississippi Tax Brackets for Tax Year 2021. 80-100 Individual Income Tax Instructions. Find your pretax deductions including 401K flexible account.

0 on the first 4000 of taxable income. If you make 82500 a year living in the region of Mississippi USA you will be taxed 14847. Eligible Charitable Organizations Information.

State Sales Tax Breadth and Reliance Fiscal Year 2021. Mississippi has a graduated income tax rate and is computed as follows. Your average tax rate is 1801 and your marginal.

The 2022 state personal income tax. The graduated income tax rate is. Taxable and Deductible Items.

5 on all taxable income over 10000. In tax year 2021 only 1000 in marginal income will be subject to the 3 percent rate with the other 1000 exempt. Hurricane Katrina Information.

If youre married filing taxes jointly theres a tax rate of 3 from 4000. Mississippi sales tax rates. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

71-661 Installment Agreement. Combined Filers - Filing and Payment Procedures. Mississippi residents have to pay a sales tax on goods and services.

Mississippi has a 700 percent state sales tax rate. If you make 150000 a year living in the region of Mississippi USA you will be taxed 34094. 4 on the next 5000 of taxable income.

Any income over 10000 would be taxes at the. 3 on the next 2000 of. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets.

If filing a combined return both spouses workeach spouse can calculate their tax liability separately and add the results. At what rate does Mississippi tax my income. Mississippi Income Tax Calculator 2021.

The next 5000 of taxable income is taxed at 4. Income Tax Calculator 2021 Mississippi. For 2021 these rates remain unchanged from 2020.

However the income thresholds for each. Mailing Address Information. Phaseout of the 3 tax bracket is now complete.

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Your average tax rate is 1350 and your marginal. Starting in 2022 only the 4 percent and 5 percent rates will.

The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. The next 1000 is taxed at 3. 0 on the first 3000 of taxable income.

3 on the next 1000 of taxable income. Outlook for the 2023 Mississippi income tax rate is to remain unchanged. How to Calculate 2021 Mississippi State Income Tax by Using State Income Tax Table.

2021 and data from the Tax. The first 4000 of taxable income is exempt. Mississippi Income Tax Calculator 2021.

How do I compute the income tax due. Mississippi Income Tax Calculator 2021. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets.

Mississippi Single Income Tax Brackets. The 2022 state personal income tax. Calculations are estimates based on tax rates as of Dec.

Tax Rates Exemptions Deductions. Mississippi also has a 400 to 500 percent corporate income tax rate.

How Long Has It Been Since Your State Raised Its Gas Tax Itep

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Mississippi Income Tax Phase Out Tax Foundation

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

Mississippi Who Pays 6th Edition Itep

Mississippi Income Tax Rate And Ms Tax Brackets 2022 2023

Mississippi Tax Rate H R Block

Mississippi State Income Tax Ms Tax Calculator Community Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Cryptocurrency Taxes What To Know For 2021 Money

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Prepare Your 2021 2022 Mississippi State Taxes Online Now

States With The Highest Lowest Tax Rates

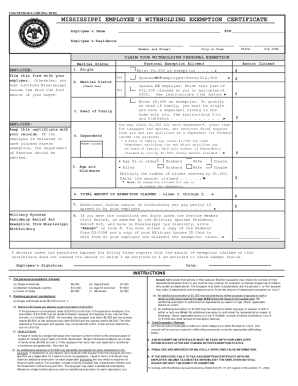

Mississippi Withholding Form Fill Out And Sign Printable Pdf Template Signnow

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today